All Categories

Featured

Table of Contents

Picking to purchase the property market, supplies, or other standard kinds of properties is sensible. When deciding whether you should buy certified capitalist possibilities, you need to stabilize the compromise you make in between higher-reward possible with the absence of coverage requirements or regulative openness. It needs to be said that personal positionings involve higher degrees of threat and can on a regular basis represent illiquid financial investments.

Specifically, nothing right here must be analyzed to state or indicate that previous outcomes are an indicator of future efficiency neither must it be interpreted that FINRA, the SEC or any type of various other protections regulatory authority approves of any of these safety and securities. In addition, when assessing exclusive positionings from sponsors or firms supplying them to recognized investors, they can give no service warranties revealed or suggested regarding precision, completeness, or results obtained from any type of information provided in their discussions or discussions.

The company ought to supply details to you through a record called the Personal Positioning Memorandum (PPM) that supplies an extra comprehensive explanation of expenditures and dangers related to getting involved in the financial investment. Interests in these offers are just provided to persons who qualify as Accredited Investors under the Securities Act, and a as defined in Area 2(a)( 51 )(A) under the Business Act or a qualified staff member of the management business.

There will certainly not be any public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were recognized for their market-beating performances. Some have actually underperformed, specifically throughout the monetary situation of 2007-2008. This alternate investing approach has an one-of-a-kind way of operating. Usually, the manager of a mutual fund will set apart a portion of their offered possessions for a hedged bet.

Real Estate Investment Partnerships For Accredited Investors

A fund supervisor for a cyclical industry might commit a part of the assets to supplies in a non-cyclical sector to offset the losses in situation the economic climate tanks. Some hedge fund managers make use of riskier methods like using borrowed cash to buy more of a property merely to increase their prospective returns.

Comparable to common funds, hedge funds are professionally handled by job investors. However, unlike common funds, hedge funds are not as purely managed by the SEC. This is why they are subject to much less scrutiny. Hedge funds can put on various investments like shorts, choices, and by-products. They can also make alternative investments.

What types of Accredited Investor Real Estate Deals investments are available?

You might select one whose financial investment approach lines up with yours. Do bear in mind that these hedge fund cash managers do not come cheap. Hedge funds normally bill a cost of 1% to 2% of the possessions, in enhancement to 20% of the earnings which works as a "efficiency charge".

You can acquire a property and obtain rewarded for holding onto it. Accredited capitalists have a lot more chances than retail financiers with high-yield investments and past.

How does Accredited Investor Property Portfolios work for high-net-worth individuals?

You must meet at the very least among the following specifications to become an accredited investor: You must have more than $1 million net worth, excluding your key house. Organization entities count as recognized financiers if they have over $5 million in properties under management. You need to have a yearly income that surpasses $200,000/ year ($300,000/ yr for partners submitting together) You have to be a licensed financial investment consultant or broker.

As a result, recognized capitalists have extra experience and money to spread across properties. A lot of investors underperform the market, consisting of certified capitalists.

In enhancement, capitalists can develop equity via favorable money flow and building recognition. Genuine estate buildings require substantial maintenance, and a whole lot can go wrong if you do not have the ideal team.

Why are High-return Real Estate Deals For Accredited Investors opportunities important?

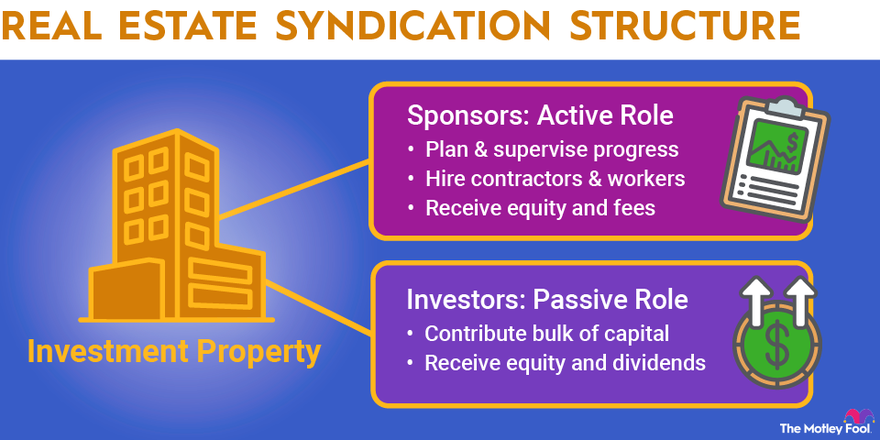

The enroller finds financial investment chances and has a group in area to take care of every obligation for the home. Real estate distributes merge money from recognized investors to acquire properties aligned with well-known goals. Personal equity real estate allows you spend in a team of buildings. Approved capitalists merge their cash together to finance acquisitions and residential property growth.

Genuine estate financial investment counts on should disperse 90% of their taxable earnings to investors as dividends. REITs permit investors to diversify promptly across several residential or commercial property courses with very little resources.

What are the benefits of Accredited Investor Real Estate Crowdfunding for accredited investors?

Financiers will certainly benefit if the stock rate rises because convertible investments provide them a lot more attractive entry points. If the stock rolls, capitalists can opt against the conversion and safeguard their funds.

Latest Posts

Delinquent Property Tax Auctions

Tax Default Properties Near Me

Excess Proceeds