All Categories

Featured

Table of Contents

- – How can Accredited Investor Property Investmen...

- – What should I know before investing in Real Es...

- – What should I look for in a Residential Real ...

- – Are there budget-friendly Private Property In...

- – What should I look for in a Accredited Inves...

- – Why is Real Estate Investment Funds For Accr...

Rehabbing a residence is taken into consideration an energetic investment approach - Accredited Investor Rental Property Investments. You will be in charge of working with remodellings, looking after professionals, and ultimately making certain the residential or commercial property offers. Energetic strategies need even more time and effort, though they are connected with huge profit margins. On the other hand, passive realty investing is terrific for investors that intend to take a less engaged strategy.

With these strategies, you can enjoy easy income in time while allowing your investments to be handled by someone else (such as a building management firm). The only point to keep in mind is that you can lose on some of your returns by hiring somebody else to manage the financial investment.

One more factor to consider to make when picking a genuine estate investing technique is straight vs. indirect. Direct financial investments entail actually buying or handling buildings, while indirect techniques are much less hands on. Several financiers can obtain so captured up in identifying a residential property type that they do not understand where to begin when it comes to locating a real residential property.

How can Accredited Investor Property Investment Opportunities diversify my portfolio?

There are lots of residential or commercial properties on the marketplace that fly under the radar because capitalists and buyers don't recognize where to look. A few of these residential properties deal with poor or non-existent marketing, while others are overpriced when noted and therefore failed to receive any kind of interest. This indicates that those financiers going to arrange via the MLS can discover a variety of investment chances.

This way, capitalists can consistently track or look out to brand-new listings in their target area. For those wondering exactly how to make links with property representatives in their respective locations, it is a good idea to attend neighborhood networking or genuine estate occasion. Capitalists looking for FSBOs will likewise find it beneficial to function with a realty representative.

What should I know before investing in Real Estate Development Opportunities For Accredited Investors?

Financiers can likewise drive through their target locations, seeking signs to locate these homes. Remember, recognizing properties can require time, and capitalists need to prepare to employ multiple angles to safeguard their next bargain. For capitalists staying in oversaturated markets, off-market buildings can stand for an opportunity to obtain ahead of the competition.

When it comes to looking for off-market residential properties, there are a couple of sources investors need to examine. These consist of public records, actual estate public auctions, wholesalers, networking events, and contractors.

What should I look for in a Residential Real Estate For Accredited Investors opportunity?

Years of backlogged repossessions and boosted motivation for financial institutions to repossess might leave even extra foreclosures up for grabs in the coming months. Financiers browsing for foreclosures must pay careful interest to newspaper listings and public documents to locate prospective residential or commercial properties.

You should take into consideration spending in genuine estate after learning the numerous benefits this asset has to provide. Typically, the regular demand provides actual estate lower volatility when contrasted to other financial investment kinds.

Are there budget-friendly Private Property Investment Opportunities For Accredited Investors options?

The reason for this is since actual estate has reduced relationship to other financial investment kinds thus using some securities to investors with other asset kinds. Different types of realty investing are linked with different degrees of risk, so make certain to find the appropriate investment strategy for your goals.

The process of getting residential or commercial property involves making a down repayment and funding the rest of the list price. Consequently, you only spend for a small percent of the building in advance yet you manage the whole financial investment. This kind of take advantage of is not readily available with various other investment types, and can be utilized to additional grow your financial investment profile.

However, as a result of the wide array of options offered, many capitalists most likely discover themselves wondering what really is the very best realty investment. While this is an easy concern, it does not have an easy response. The most effective kind of investment residential or commercial property will certainly depend upon lots of elements, and financiers must be mindful not to rule out any choices when looking for prospective offers.

This write-up discovers the opportunities for non-accredited financiers aiming to endeavor right into the profitable world of realty (Real Estate for Accredited Investors). We will certainly delve into numerous financial investment methods, governing considerations, and approaches that equip non-accredited individuals to harness the potential of real estate in their financial investment profiles. We will certainly additionally highlight exactly how non-accredited capitalists can function to end up being certified investors

What should I look for in a Accredited Investor Commercial Real Estate Deals opportunity?

These are typically high-net-worth people or companies that meet accreditation needs to trade private, riskier investments. Revenue Criteria: People must have an annual earnings exceeding $200,000 for two consecutive years, or $300,000 when combined with a partner. Internet Worth Need: An internet well worth exceeding $1 million, omitting the main residence's worth.

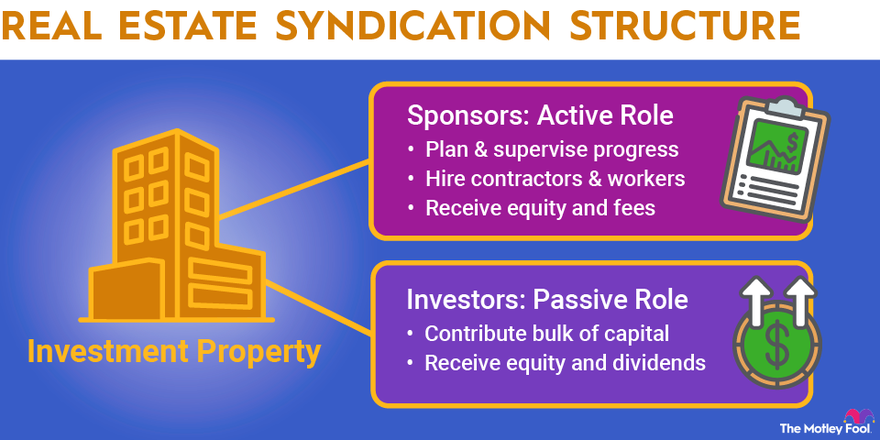

Financial investment Understanding: A clear understanding and understanding of the risks connected with the financial investments they are accessing. Paperwork: Capability to supply financial declarations or other documentation to validate revenue and total assets when asked for. Property Syndications require certified financiers due to the fact that sponsors can only permit accredited financiers to sign up for their financial investment chances.

Why is Real Estate Investment Funds For Accredited Investors a good choice for accredited investors?

The initial common mistaken belief is when you're a recognized capitalist, you can maintain that status forever. To come to be a recognized financier, one should either hit the earnings requirements or have the internet worth requirement.

REITs are eye-catching because they produce more powerful payouts than conventional supplies on the S&P 500. High yield dividends Portfolio diversification High liquidity Dividends are strained as ordinary earnings Level of sensitivity to rate of interest Threats related to details properties Crowdfunding is an approach of online fundraising that includes asking for the public to add money or startup funding for brand-new jobs.

This enables entrepreneurs to pitch their ideas straight to daily web individuals. Crowdfunding offers the capability for non-accredited financiers to end up being investors in a business or in a property building they would not have actually had the ability to have accessibility to without certification. One more benefit of crowdfunding is profile diversification.

In numerous situations, the investment candidate requires to have a track record and is in the infancy phase of their task. This could imply a greater risk of shedding an investment.

Table of Contents

- – How can Accredited Investor Property Investmen...

- – What should I know before investing in Real Es...

- – What should I look for in a Residential Real ...

- – Are there budget-friendly Private Property In...

- – What should I look for in a Accredited Inves...

- – Why is Real Estate Investment Funds For Accr...

Latest Posts

Delinquent Property Tax Auctions

Tax Default Properties Near Me

Excess Proceeds

More

Latest Posts

Delinquent Property Tax Auctions

Tax Default Properties Near Me

Excess Proceeds